Liquid Staking has opened a dynamic realm of DeFi on MultiversX, which takes the staking mechanism a whole step further by generating yield for you while allowing you to access the locked funds through other dApps.

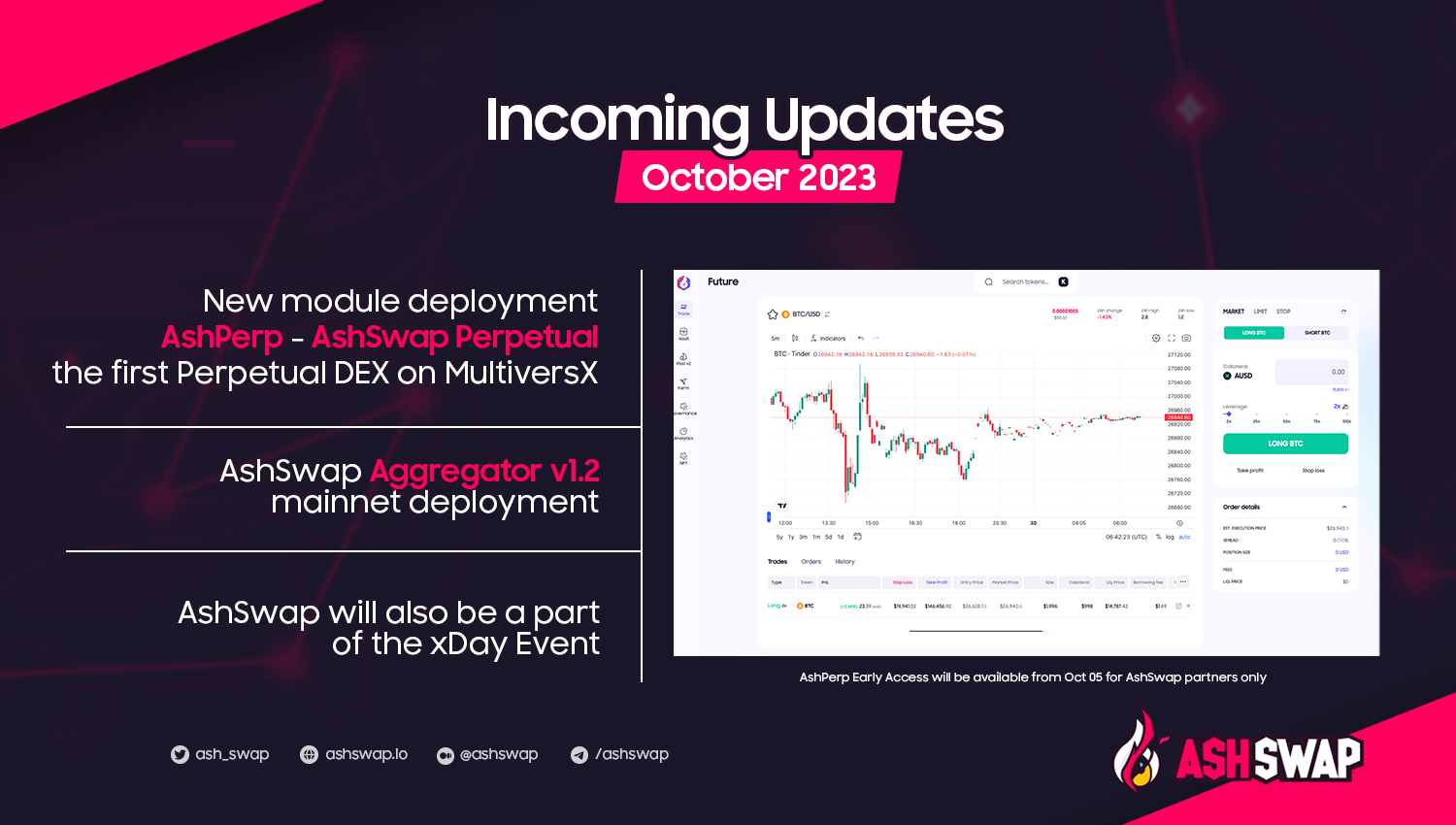

This article delves into Yield Optimization Strategies on AshSwap and Hatom Protocol, two leading platforms in Liquid Staking and DEX on MVX.

Whether you’re a DeFi aficionado or new to the scene, join us to uncover a new way of optimizing yields.

What is Hatom Protocol ?

Hatom Protocol is a decentralized lending, borrowing, and staking protocol operating on the MultiversX Network. It provides opportunities for liquidity providers to earn interest on their assets and enables borrowers to secure loans by collateralizing their assets.

Let’s walk through Hatom’s featured products and some definitions that you should be familiar with before apeing in your DeFi journey.

Hatom Liquid Staking

Liquid Staking is a module that allows users to stake their EGLD without locking up its value.

sEGLD or Staked EGLD is a receipt token when you liquid-stake your EGLD on Hatom. It can be used on dApps like Automated Market Makers (AMMs), Lending Protocols, and NFT Marketplaces.

Hatom Novel Liquid Staking allows users to generate even more yield by introducing a boosted version of sEGLD called HsEGLD.

HsEGLD or HatomStaked EGLD is an interest-bearing version of sEGLD that you will get when supplying the sEGLD on the lending protocol. HsEGLD combines both the Staking Rewards received from validators and the Borrowing Interest earned from Lending Protocol. You can also activate HsEGLD as collateral and earn additional rewards.

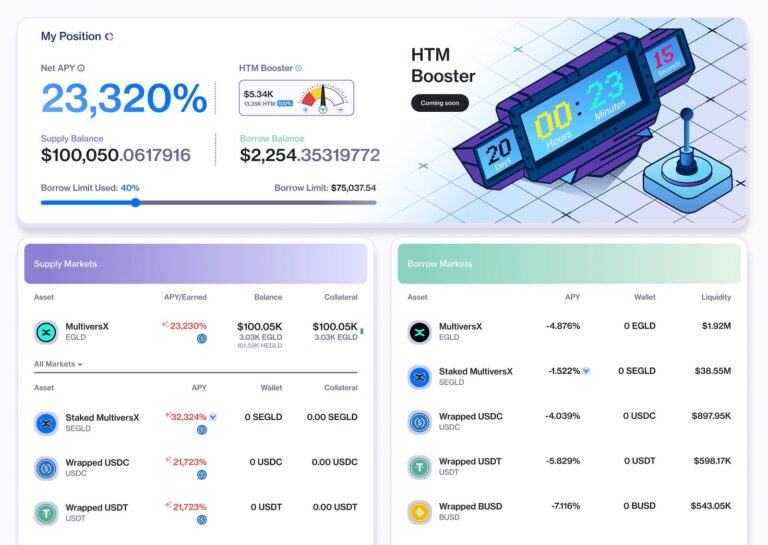

Hatom Lending Protocol

Hatom Lending Protocol is a decentralized lending and borrowing platform.

Liquidity providers, or suppliers, supply assets to the Money Market, thereby earning interest on their deposits. The HsEGLD from Hatom Novel Liquid Staking would enable users to create even greater yields from Lending Protocol.

In order to borrow assets from Hatom, you have to deposit an asset to be used as collateral on the Lending Protocol.

We recommend you learn more details about Hatom Lending Protocol on their document.

Thanks to the launch of Liquid Staking providers like Hatom Protocol, users own their power to unlock the value of the staked assets while contributing to the decentralization of the MultiversX blockchain. EGLD long-term stakers are now able to earn their staking rewards and additional yields on other dApps simultaneously, such as AshSwap.

How to optimize your yields with AshSwap

The possibilities of liquid staking will not be fully exploited until you are thoroughly aware of how to utilize them on AshSwap and Hatom Protocol. Below, we provide you with the three most-used strategies for optimizing yields from liquid staking.

Strategy 1 : Liquidity Provision on AshSwap

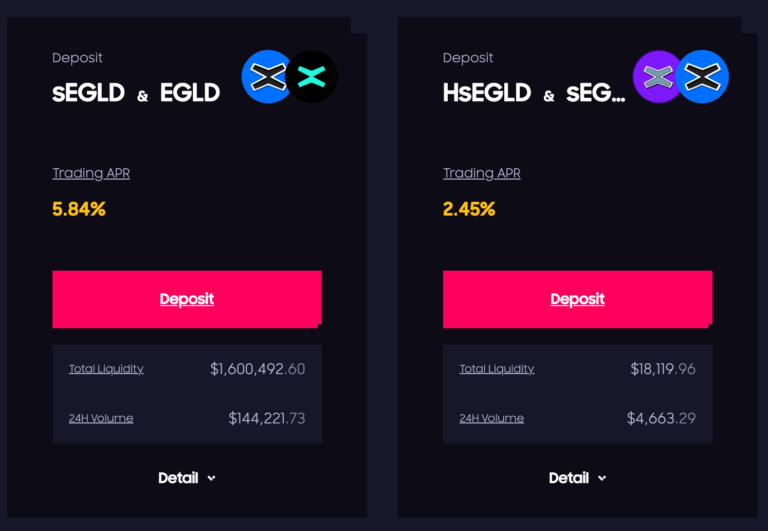

This is the simplest and lowest-risk way to maximize the value of your sEGLD.

- Liquid-stake your EGLD on Hatom Protocol to get sEGLD

- Deposit sEGLD into the AshSwap sEGLD-wEGLD pool to share 50% of our total trading fee.

- Stake sEGLD-wEGLD LP tokens in AshSwap Liquidity Mining to earn up to 15% APR (at the time of writing).

- (Optional) Stake ASH to the AshSwap Governance Stake to get veASH. The farming APR you receive can even be boosted up to 2.5 times by veASH.

- You can always withdraw your sEGLD out of the liquidity pool without a cooldown period and swap back to EGLD instantly on the AshSwap Aggregator. (Hatom allows users to unstake their EGLD, but you have to wait for a 10-day cooldown.)

Strategy 2: Hatom Lending Protocol and AshSwap Liquidity Provision

Another brilliant way to reap more yields from your primitive assets is to practice a combined yield strategy between Hatom Lending Protocol and AshSwap.

Hatom has launched its $3 Million Incentivization Program to bootstrap Money Markets while ensuring a continued high APY and sustainable TVL. Since most of those incentives go to sEGLD lenders, you can take advantage of that lucrative program by following the steps below:

- Liquid stake EGLD on Hatom Protocol to get sEGLD

- Lend your sEGLD and activate them as collateral to borrow EGLD.

- Add EGLD to AshSwap liquidity pools (BUSD-EGLD or sEGLD-wEGLD, whichever offers a higher APR) to earn fees and harvest more yields from ASH Farms.

- (Optional) Boost your yields just by staking ASH

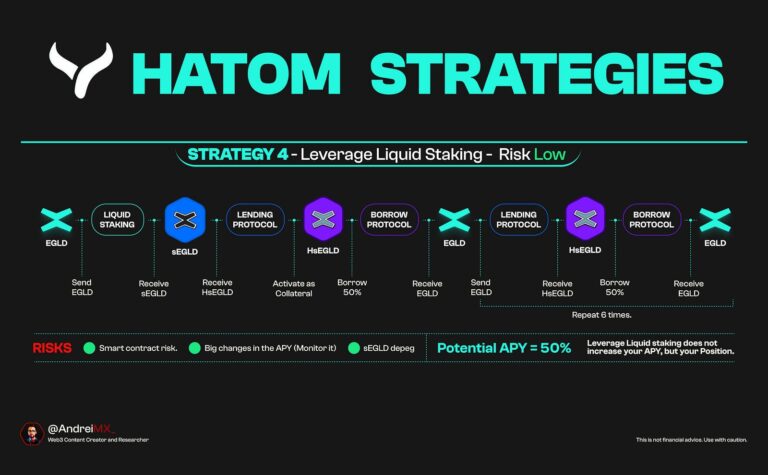

Strategy 3 : Leveraged Liquid Staking (High risk)

Looping is simply a DeFi strategy where an investor supplies an asset and borrows against that asset in a repeated cycle. This strategy can help you maximize profits. Follow these steps to create your own loop:

- Liquid stake your EGLD on Hatom Protocol to get sEGLD

- Supply sEGLD in the money market, get HsEGLD in return

- Use HsEGLD to activate as collateral to earn Hatom’s grant

- Borrow EGLD against HsEGLD

- Repeat step 1

Q: What are the benefits of this strategy?

- Increased yield on the initial stack of assets. This is what “leverage” means at its core.

- The liquidation risk is minimal since you are borrowing EGLD against HsEGLD, another EGLD type.

- Possibility to earn APY from both lending and borrowing.

Q: What are the potential risks?

Although it seems like a riskless strategy, money doesn’t grow on trees. It definitely comes with a risk.

When a lot of people borrow EGLD for looping, the utilization ratio increases. As a result, the interest rates on Hatom may surpass your APY.

The longer you borrow EGLD, the more interest accrues on the loan. You are consequently forced to pay back your loans and deleverage your positions to avoid suffering losses. However, there is a bottleneck here; you cannot unstake sEGLD for EGLD immediately on Hatom due to the 10-day cooldown.

This is when AshSwap steps in.

We collaborate with Hatom to provide a strong, liquid secondary market for sEGLD and HsEGLD trading. By swapping through the sEGLD/EGLD pool on AshSwap, users can get liquid EGLD to repay their loans.

Q: Should I worry about sEGLD depeg?

Users probably do not need to be concerned about the depeg.

AshSwap V2 pools are designed with dynamic peg, which will help us retain the peg, despite the pools are imbalanced. This specification sets AshSwap apart from other DEXs.

Neil — CEO of Ashswap Tweet

If you are an AshSwap liquidity provider, veASH holder, or EGLD arbitrageur, the depeg event is, to some extent, a precious chance to buy sEGLD at a decent discount on AshSwap. Whenever you withdraw your sEGLD from Ashswap pools, you can always redeem them for EGLD on Hatom in a 1:1 ratio and earn from the price difference.

AshSwap x Hatom: A new way to power up your DeFi journey on MVX

The partnership between Hatom and AshSwap gives DeFi on MultiversX a new playground where you can try out different ways to generate yields. Together with Hatom, we are delighted to be the leading Stable-swap AMM DEX and Auto-Concentrated Liquidity that help build a reliable puzzle in the MultiversX DeFi ecosystem. We are aiming to build a DeFi layer for the benefit of MultiversX users and developers.

The launch of many DeFi protocols and the new listings are worthwhile events that we have been looking forward to for some time. It is time for AshSwap liquidity providers and veASH holders to capture new earning opportunities. And remember, we’re only getting started here.