Decentralized Exchange & Stable-Swap

After months of planning, development, and no lack of shadowing, Maiar Exchange was officially launched on the Elrond blockchain, setting the foundation for later Defi development in November 2021. The Elrond team has good reasons to choose a decentralized exchange (DEX) to be Elrond’s first official decentralized application. Any blockchain that supports Defi has to have (decentralized) exchanges to facilitate trading and capital circulation, just like any traditional economy.

Since the birth of Uniswap in 2018, a myriad of automated market makers (AMMs) has been born to serve different trading purposes. For example, trading speculative assets requires a different mechanism compared to stable assets. From this stems various inventions. One of the most noticeable is Curve Finance (Curve), which has a unique design called the StableSwap invariant. Not only does this appearance reduce the slippage to improve liquidity and reduce slippage for trading between assets with stable prices, but Curve has also grown to be ranked first in TVL on Ethereum and existing on multiple blockchains. This has proven that stable-swap decentralized exchanges are one of the most valuable pieces in the decentralized finance (Defi) ecosystems.

These decentralized exchanges have done wonders to the blockchain and cryptocurrency world. In our view, they (not single-handedly) pull the crypto train to its ATH. They, however, are not perfect and suffer from a similar set of problems, namely impermanent loss (IL), capital inefficiency, and governance token inflation. In this paper, we will examine the problems and take a peek at how AshSwap aims to solve them.

Impermanent Loss

Impermanent loss(IL) occurs as a result of asset rebalancing by the Automated Market Maker(AMM) as prices of the assets(tokens) in an LP position diverge from their starting ratio to each other. IL is the equity loss of an asset in an LP when compared to simply holding said asset by itself.w

Any Defi farmer needs to understand the risk to become a liquidity provider. In a world of volatility like crypto, understanding the market dynamics to prevent losses is as important as knowing how to detect opportunities. Different methods have been adopted, but the most prominent one is single-sided liquidity provision; Bancor, Platypus are of this sort.

Fortunately, in the context of stable-swap, IL is not really a huge issue as prices of the assets in the pools are very unlikely to stay out of peg. Platypus has raised a notable point that even though stable assets’ values are similar, their market liquidity is different.

Impermanent Loss remains < 2% as long as the relative prices of the asset in your LP pair stay within 50% of your entry! Source: Alpaca Finance

It is very unlikely this event (50% change in the relative prices of stablecoins in the pool) will happen. If it does, we crypto community has a much bigger issue to deal with than impermanent loss

Capital Inefficiency

AMMs mark a new page in the development of decentralized finance as people now are able to trade their assets in a completely decentralized way. There now are no intermediaries standing between users, only smart contracts, making trading trustless, and cheap. To achieve that, there need to be people who first put up capital to create liquidity and facilitate the trades, hence the name liquidity providers (LPs). This, however, poses another problem of capital inefficiency because a large amount of capital sits idle in those pools waiting to be traded. This leads to either LPs moving their capital around trying to get the most out of it, or their money is stuck in the pool and out of circulation.

Governance Token Inflation

To attract enough capital to make the liquidity pools tradeable, many protocols employ a method named liquidity mining. The name might stem from the mining process of Bitcoin where miners are rewarded when they provide computing power to help run the blockchain. In DEXs, users are rewarded with governance tokens. This is helpful in some cases like if you are bootstrapping your protocol or want to launch an infamous “vampire attack” (what Sushiswap does to Uniswap). Sometimes, the APY for those farms can go up to 5 or 6 figures, but there is no free meal.

The resultant problem is often users end up with so many tokens without anything to do except for voting in unestablished DAOs, so most likely users will dump their tokens in the open market, hurting the project and its investors.

AshSwap

AshSwap is a decentralized AMM following the stable-swap model built on the Elrond Blockchain. AshSwap uses the same formulas invented by Curve Finance but introduces some new concepts to improve user experience, increase capital efficiency, and create a more robust token model.

Terms:

- ASH: the governance token of AshSwap

- veASH: vote-escrow ASH, a concept of Curve. AshSwap does not have any voting mechanism at the beginning, but we keep the naming convention for the sake of consistency.

1. Trading Fee

No project wants users to sell their tokens, so they either lock tokens (for seed or private sales), or direct users to staking. By doing so, a part of the token supply will be taken out of circulation and reduce sell pressure. The staking use case is likely to create the inflation problem that will be considered in the latter part of the paper, so we need to have a more sustainable incentivization mechanism.

AshSwap divides the fees collected into 2 parts. 50% will go to the LP token holders where the trades were performed and the other half will go to veASH holders. This encourages users to stake the governance token to earn parts of the revenue of the protocol.

2. Liquid Liquidity Provision

Liquid Liquidity Provision (LLP) is a new concept that AshSwap introduces in which users do not have to give up their liquidity but exchange it instead. This also adds more use cases to the ASH token and increases revenue for both LPs and AshSwap. Sounds good? But how does it work?

Collateralized Stablecoin

One of the most prevalent forms of stablecoins is crypto-back stablecoin. Some examples are DAI (MakerDAO) and MIM (Abracadabra.money). Because the underlying collateral is speculative assets, a prerequisite in those protocols is liquidation. When the underlying assets fell under a certain price, liquidators will step in, liquidate the position, burn some of the stablecoins to keep their pegs.

The most recent crash (January 2022) in crypto witnessed a very big liquidation of 600 million being liquidated on MakerDAO, causing the price of ETH to crash by a few hundred dollars in a matter of hours as all of the collateral was sold on the open market. And history shows that there were times the liquidation failed to work if the price falls too low, too fast. Also, liquidator bots are software and sometimes they do fail.

AshSwap does not eliminate the possibility of having this kind of operation in the future, but a lot of research and considerations are needed to make sure things work.

Introduce a new Stablecoin

LP tokens of stable-swap exchanges have a very unique characteristic that at the end of the day, the collateral’s underlying value does not change much. Leveraging this, AshSwap allows users to mint a new type of stablecoins — AOC – using their LP tokens as collateral. This means users can provide liquidity to the DEX, receive the same amount of stablecoin, and put them to work to get yield in other protocols.

One question arises from such an act, who will be entitled to the trading fee rewarded to the LP tokens? It’s the users, in one way or another.

Speculate on LPs

When a user decides to mint AOC, he has to pay a maximum amount of 1% fee in the form of ASH tokens, but he has the right to choose how much ASH fee he wants to pay. The fee will be proportional to the percentage of the trading fee of the LP he decides to share with AshSwap.

If he is a hard-core farmer and wants to earn yields for a long time, he should pay all the 1% ASH fee, double his asset, and double (depending on the effectiveness of his decisions) his yields. The fee will then be used to reward ASH stakers or burned to make the ASH token scarce.

On the other hand, if he only needs AOC for a short while and the 1% fee makes it not worth it, he can give part (or all) of the trading fee to AshSwap during that time to reduce the fee. The trading fee will be used to buy back ASH on AMMs (like Maiar) and distribute to ASH stakers or burned.

In either case, the ASH holders, the speculator, and AshSwap all win.

AOC Adoption

Let’s take an example.

Alice needs AOC, and she has 200 USDC. Alice can go to USDC/USDT pool, swap 100 USDC to 100 USDT, add liquidity, and use the LP as collateral and mint 200 AOC while giving a 100% trading fee to AshSwap. Although there are quite some actions needed, the whole process can be simplified as a simple swap from 200 USDC to 200 AOC.

By swapping to AOC, Alice gives AshSwap $200 worth of fee-bearing LP tokens. The fee will then be swapped to ASH and distributed to other ASH holders in one way or another. This means the more AOC gets used, the more LP tokens AshSwap has, creating a positive feedback loop that benefits all the people involved.

Listing Partnership

In the future, many projects will be listed on Maiar Exchange against stablecoins like USDC. If there are 100 projects, and each project has a liquidity pool that is worth 1 million dollars, it’s 50 million dollars worth of stablecoins put in 100 pools.

Instead of adding stablecoins straight to the pool, 50 million can be added to the stablecoin pool of AshSwap. The LP tokens are given to AshSwap to mint 50 million AOC (either pay ASH fee or not) which is then used as liquidity on Maiar Exchange. This brought benefits to all parties:

- AshSwap pool’s liquidity is deepened, traders can trade larger volumes with less slippage

- AshSwap receives some LP tokens, thus increasing its revenue

- veASH holders have more yields

- Projects still have token/stablecoin pool while enjoying the trading fee & ASH farming reward. Projects and AshSwap can also be coordinated to give them a better rate than normal LPs.

3. Social Mining

In a normal liquidity mining model, users are rewarded with governance tokens and trading fees for providing liquidity. The amount of reward they can get is proportional to the capital they put in. This is good for people with big wallets, but for retail investors with three figures in their account, juicy yield farming might not be able to cut it. Yet retail has many powers that have not been mined (or rewarded), such as enthusiasm and network effects.

To incentivize retail, we want to integrate multiple products into our ecosystem that do not require users to put up a large amount of capital but still provide good rewards.

Gaming

Exchanges have a great utility in Defi, there is no doubt about that, but they have trouble keeping the users. Users often come to the exchanges to trade or check their rewards. To be fair, exchanges are not that fun to hang around. AshSwap since the very beginning has always wanted to counter this; we want to create an exchange that is not only useful but also easy and fun to use.

Gaming is very well suited for this job. Anyone who wants to contribute to the product and wants to earn some rewards on performing some actions to complete quests provided by AshSwap. These quests can be dropped announced or unannounced, so who wants to play has to pay attention. This helps increase the engagement and the network effects of the product.

Nevertheless, there’s one problem with this. Because we pay users to perform such actions, we do not know for sure if someone would create thousands of wallet addresses and spam the game for reward. Thanks to blockchain and NFTs, we have the solution.

NFTs

At some point in the near future, we will allow users to mint NFTs. Owning these NFTs means you are a part of AshSwap community and earn your rights to participate in our activities like Gaming, and later Governance (will be revealed later).

NFTs projects often find it hard to add use cases to their NFTs. JPEGs and art are all good, but when NFTs are embedded in a strong ecosystem with multiple use cases, it can go a longer way.

4. Roadmap

2022

- Mainnet Launch

- TGE (Token Generation Event)

- AOC Minting

- Token Farming

- NFT Gamification

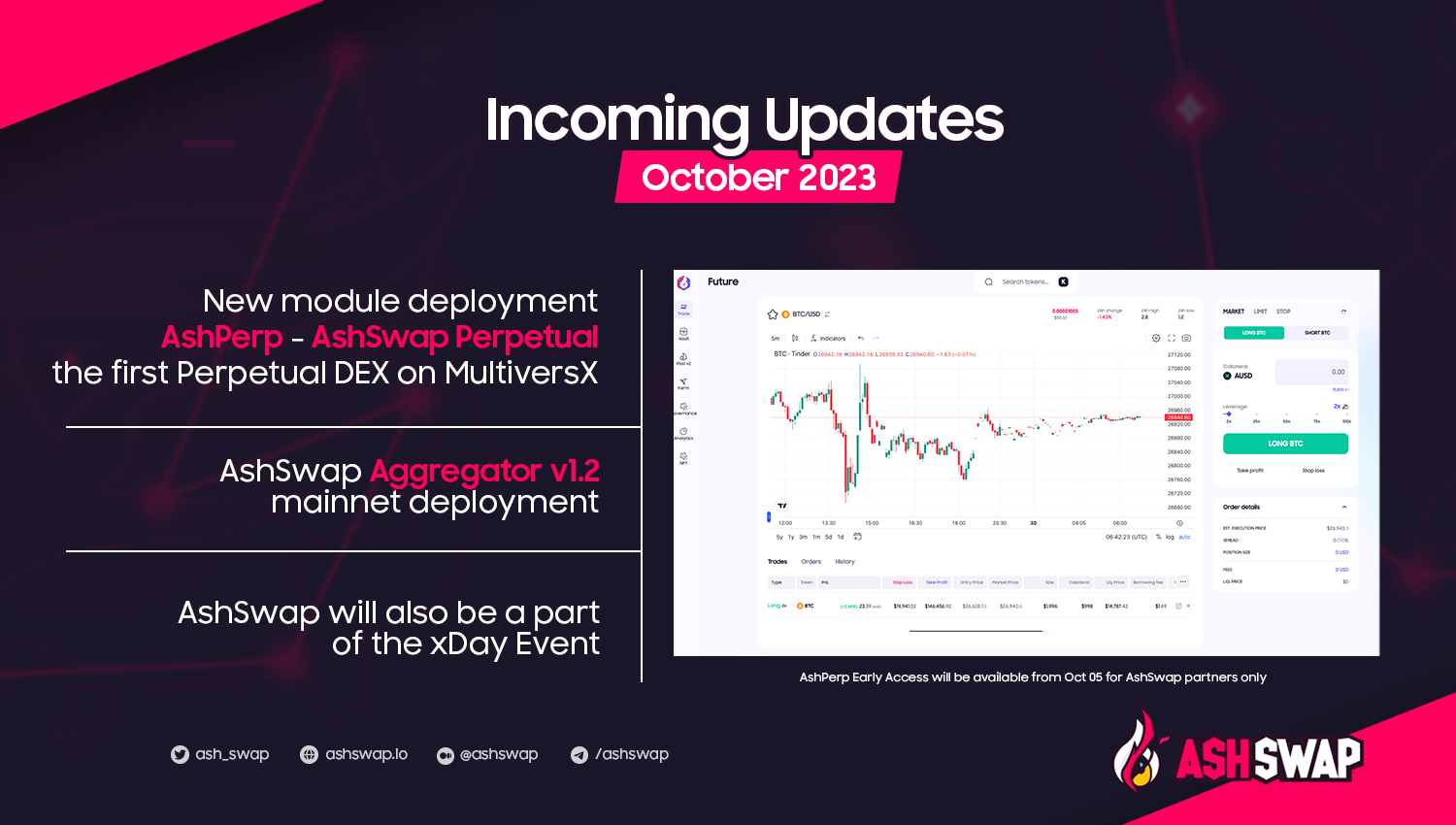

2023

- More pool versions

- Integration with other DeFi protocols

- Ash DAO

2024

- NFT Gamification

- AOC Use Case Pushing

- Kashi model for AOC

- Unstable trading pairs

- Liquid Staking