Why is low liquidity a problem?

As we mentioned in the previous articles in DeFi 101 Series; one of the main challenges with DeFi was the lack of liquidity. But on the other hand, as of December 2020, there were almost 15 billion dollars of value locked in DeFi protocols, and one of the core technologies behind that rapidly raising was the liquidity pool.

What is Liquidity Pool?

A liquidity pool is a crowdsourced pool of tokens or cryptocurrencies locked in a smart contract that is used to facilitate trades between the assets on a decentralized exchange (DEX). It creates liquidity for transactions with the help of automated market makers (AMMs), which allows digital assets to be traded in an automatic and permissionless way.

People who provide their tokens to the liquidity pools are called liquidity providers (LPs). LPs will receive LP tokens when providing liquidity to the pool and that amount of LP tokens can be used in many ways on a DeFi protocol.

Some popular names using liquidity pool mechanisms are SushiSwap and Uniswap running on the Ethereum network; PancakeSwap on BNB Chain and AshSwap on the Elrond network.

Why Liquidity Pool is important?

A market with low liquidity results in high slippage — a large difference between the expected price and executed price of a token; it often happens during periods of high volatility, or when a large order is executed but there isn’t enough available token to be traded.

Another scenario is when you want to trade from token A to token B on a protocol that does not have enough liquidity for a given trading pair (e.g. USDC to USDT), you will be stuck with the tokens that can not be sold.

Liquidity pools aim to solve this illiquid problem by incentivizing users themselves to provide liquidity for a share of trading fees.

How do Liquidity Pools work?

As mentioned above, DeFi protocols motivate and reward LP for staking their assets in the pool; rewards can come in the form of crypto rewards, or, a fraction of trading fees from exchanges where they pool their assets in.

We will give you an example of how that works: Neil — a trader investing $1,000 in a USDC-USDT pool using AshSwap, and these are what he will do:

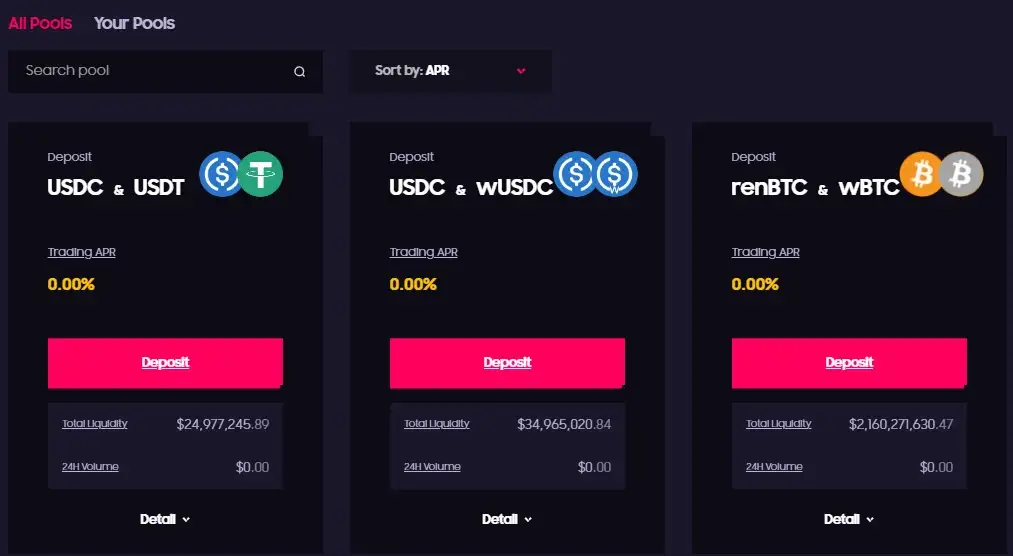

1. Go to AshSwap;

2. Find the USDC-USDT liquidity pool;

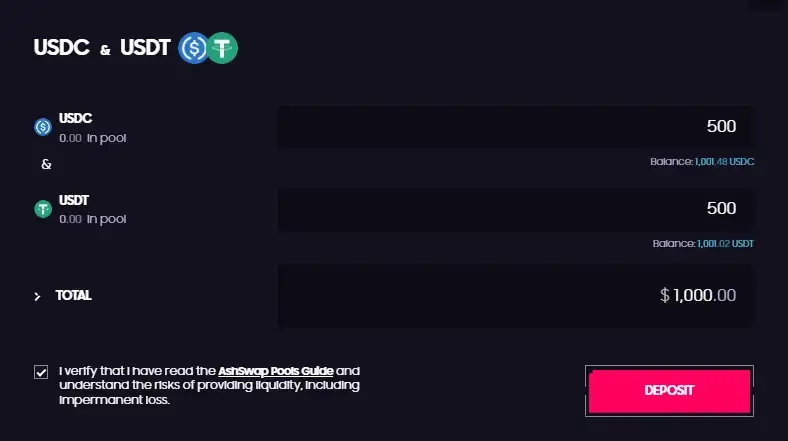

3. Deposit a 50/50 split of USDC and USDT to that pool (which is $500 USDC and $500 USDT in this case);

4. Receive USDC-USDT LP tokens;

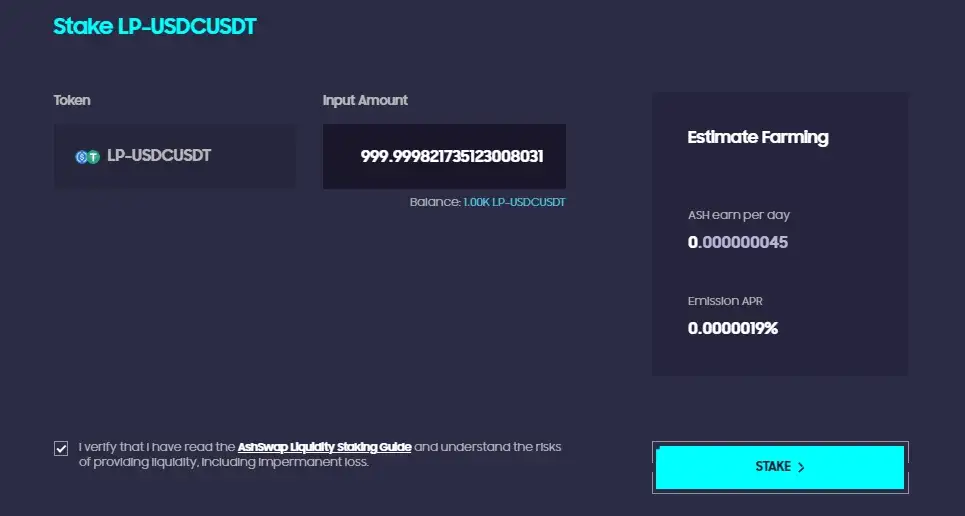

5. Deposit this LP token amount to the USDC-USDT staking pool;

6. Get the ASH token as a reward.

The USDC-USDT pair that was originally deposited would be earning a portion of the fees collected from exchanges on that liquidity pool, and, you would be earning ASH tokens in exchange for staking your LP tokens.

You provided liquidity, and then what’s next?

So far, pooling liquidity is a simple concept, and then it can be used in a number of different ways.

Various protocols offer more incentives for LPs for particular “incentivized” pools in order to create a better trading experience; and by participating in these incentivized liquidity pools as LPs, users are able to get the maximum amount of LP tokens, which is called Liquidity Mining — this is how LPs can optimize their LP token earnings.

And then, there are many different DeFi markets, platforms, and incentive pools that allow users to earn rewards for providing and mining liquidity via LP tokens; then, how do LPs know where to place their funds? And then there is another term coming in: Yield Farming — this is the practice of staking or locking up assets within a blockchain protocol to generate tokenized rewards, and when LPs stake or lock up tokens in various DeFi protocols, they will have a way to generate maximize earnings.

Final Thought

Attracting liquidity is a tough fight when investors constantly chase high yields; however, as one of the core technologies behind the current DeFi technology stack, they already help enable decentralized trading, lending, yield generating, and the list is still going on.

If you want to know more details about LP tokens, let’s take a look at our article from Mr. Neil Nguyen; or our DeFi 101 Series for exploring more about DeFi knowledge.