AOC The Stable(Coin)

The name “AOC” — AshSwap One (Stable)Coin — is inspired by the “One Ring” in the legendary fiction series Lord of The Rings (LOTR) by J. R. R. Tolkien. On AOC carved this verse.

One (stable)Coin to rule them all, One Coin to find them, One Coin to bring them all and in the darkness bind them.

Cryptocurrency markets, especially in DeFi, have always had troubles with token liquidity. Not just for the act of trading tokens, but to bootstrap protocols and improve users’ yields. The term “liquidity” is very wide, but in this document, we only touch it in the context of stablecoins (and stablecoin swap). We know that the current models of stable-swap (and AMM in general) have an inherent problem.

Capital Inefficiency happens to AMMs when a huge amount of capital is taken out of circulation and locked in the liquidity pools to facilitate trades. This is needed to remove intermediaries, but it is clearly not efficient.

Collateral

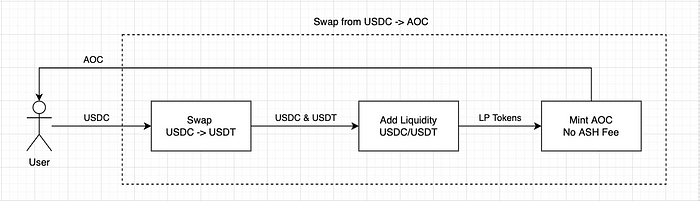

AshSwap allows users to mint AOC using AshSwap LP tokens as collateral. This can happen thanks to the unique characteristic of stable-swap LP tokens that they don’t change (much) in value even the ratio of the underlying tokens changes.

💡 For example, you started providing liquidity to AshSwap USDC/USDT pool with 50 USDC and 50 USDT (the pool’s ratio was 1:1); and the value was $100. After some time and trades, the ratio changed to 2:1, if you withdrew, you would end up with 66.67 USDC and 33.33 USDT. And because 1 USDC or 1 USDT both equal $1, even you have different amounts of the tokens, your holding value in dollars stayed at $100 and didn’t change.

With the minting rate of 1:1, which means $100 worth of collateral can be used to mint $100 worth of AOC, this instantly doubles the liquidity in the ecosystem. The beauty of this is that it does not create any more money, but only a “wrapped” version of the locked money in the pool.

To do this, at first, users need to provide liquidity to AshSwap’s pools and get LP tokens. Then they can go on and lock those LP tokens in the AOC contract and get back AOC in return. This process has some more details and implications which will be analyzed in later sections.

ASH Fee

ASH holds a very essential role in the process of minting AOC. Users can choose to pay all, a part of, or no ASH fee to mint AOC, and each action has its own effects. Regarding the two extremes, if a user pays the whole fee, he will be entitled to all the trading fees of the collateralized LP tokens, and if he pays nothing, all the trading fees will belong to AshSwap. But he can very well choose any ratio on the fee spectrum to suit his needs. For example, he can pay 25% of the fee, so he will get 25% of the trading fee and the rest goes to AshSwap.

The current tentative fee is 1% of the value of the minted AOC. This can be subject to change in the future.

LP Reward

Minting AOC or not, the LP token holders can still benefit from other interest-bearing scenarios.

- Trading fees: they still are entitled to the fee and can claim any time even when their LP tokens are locked.

- Farming: AshSwap will distribute ASH tokens to liquidity providers of certain pools. This can be similar to the model of Curve, will we have Ash wars and some protocol that attains this to become a phoenix (as a winner)?

AOC Dynamics

AOC ↔ Stablecoins Swap

The whole purpose of having AOC is to increase the liquidity in the Elrond ecosystem, so it is pointless if we add AOC back to stablecoin pools on AshSwap, even to a Meta-pool. Instead, we can bundle multiple actions of swapping/minting/burning to form a pseudo-swap action that appears to be the same to users (but more gas-intensive).

One key point to note is only users who have minted AOC have the right to burn AOC to get back their LP tokens (stablecoins). This results in an opportunity for speculation and arbitrage which will be detailed in a later section.

The Peg

For a stablecoin to function properly, it needs to hold the peg in one way or another. For asset-backed stablecoins like USDT or USDC, users can always redeem their coins to real-life assets; for algorithmic or crypto-backed stablecoins, they rely on active market makers like arbitrageurs or liquidators. In the case of AOC, which is a crypto-backed stablecoin, arbitrage is the key to its peg.

Over Peg

This is fairly simple because anyone can swap directly from other stablecoins to AOC with the rate of 1:1, arbitrageurs will monitor the value of AOC and bring it back to the peg as soon as the over peg happens.

Below Peg

It is more tricky to recover the peg when it goes below because only those who already minted AOC can do so, but it is somewhat an advantage. The price of AOC, of course, is the same as other coins/tokens as it depends on the balance between supply and demand. However, at the end of the day, because the AOC minters will need AOC to get back their collateral, which is supposedly better money compared to AOC, they are willing to pay at most the equal value of their collateral to purchase AOC. We can say regardless of the market price, AOC has an intrinsic value of $1.

Nonetheless, we still need to maintain AOC peg in day-to-day operations. Thankfully, arbitrageurs will come and save the day, but how does that work? Let’s look at an example to understand this better.

Bob is a crypto guy who loves profits, yet is scared of volatility, so he decides to become a stablecoin yield farmer on AshSwap. He adds $1000 worth of liquidity to the USDC/USDT pool, gets back his LP tokens, and puts them on farms like others. But Bob notices that he can get even more benefit if he makes use of arbitrage, so he comes up with a simple yet powerful strategy. He uses his LP tokens as collateral and mint 1000 AOC (while still benefiting from trading fees in the pool), exchanges it back to USDC by swapping AOC → EGLD → USDC for example (not withdrawing liquidity), and now he has 1000 USDC handy. On a rainy day, AOC depreciates in price, 1 AOC equals 0.95 USDC; supposedly, there is no direct pool from AOC/USDC so the prices are denominated in EGLD. Now Bob notices the difference and instantly exchanges his 950 USDC to 1000 AOC, since 1000 AOC can be used to get back $1000 worth of USDT/USDC his remaining 50 USDC is his profit. And by doing so, Bob makes 5% profit without breaking any sweat and also helps restore the peg of AOC.

Discussion

The unique mechanism of AOC minting brings to the Elrond blockchain many new dynamics. These can result in different and new use cases of farming, staking, or DAO. Different stakeholders can participate in the ecosystem and benefit from it. The only limit is your imagination.

If you want to discuss this more, join our discord at https://discord.gg/RxcVQ3ME32

About Ashswap

AshSwap is the first decentralized exchange built on the Elrond blockchain that allows users to trade between stable assets with high volume and small slippage. As Elrond grows to become the infrastructure of DeFi, more types of stablecoins will flow in, and users will need a place to swap them.

Check out our social channels:

- Website: https://ashswap.io/

- Discord: https://discord.gg/RxcVQ3ME32

- Twitter: https://twitter.com/ash_swap

- Telegram: https://t.me/ashswap